Philadelphia has long touted its 10-year tax abatement

program as a winner. It entices people to build and buy new homes while making

Philadelphia an attractive place to do business, the city would say.

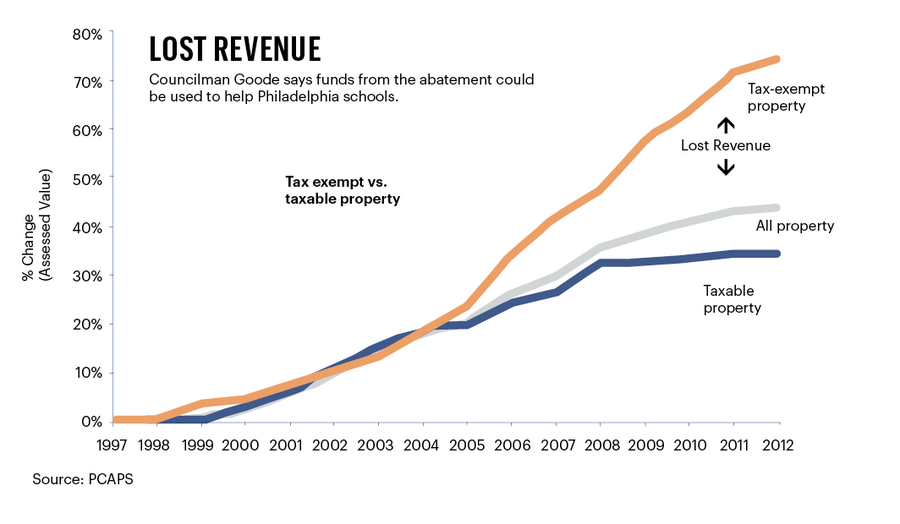

But Philadelphia Councilman W. Wilson Goode Jr. says that

the tax abatements remove taxpayer dollars that could help the city's

fledgeling public school system. Instead, it just helps wealthy developers and

rich home buyers, he said.

In fact, the city lost more than $1.5 million in tax revenue

from the Comcast Center — which could pay for nine teachers and 12 nurses,

according to Philadelphia Coalition Advocating for Public Schools (PCAPS).

In this week's centerpiece

story, real estate reporter Natalie Kostelni examined the controversy that

the 10-year tax abatement fuels between the city and developers. She also spoke

to home buyers that thought their properties came with the abatement, but

actually didn't.

Check out the accompanying infographic to see just how much

tax revenue was lost from the abatement, according to PCAPS.

Source: Philadelphia Business Journal

No comments:

Post a Comment