Pennsylvania held up better than most states during the recession of

2008 and 2009 and early portion of the recovery. But a Wells Fargo & Co.

survey finds that the state’s recovery has slowed

in the past couple of years, citing a slowdown in natural gas exploration due

to price increases, declining momentum in the service sector and a sluggish

housing recovery.

Pennsylvania job growth has lagged behind the national average

recently, the study says. Nonfarm employment grew just 0.7 percent over the

past year, compared to a 1.7 percent gain nationwide. Goods producers,

government, and retail/ wholesale trade are the principal drags on the state’s

economy.

While manufacturing jobs have been falling for decades, they appear to

have bottomed out due to the growing investment in the state’s energy sector.

International trade, which had fueled growth earlier, has moderated, and

exports are equal to 2011 levels.

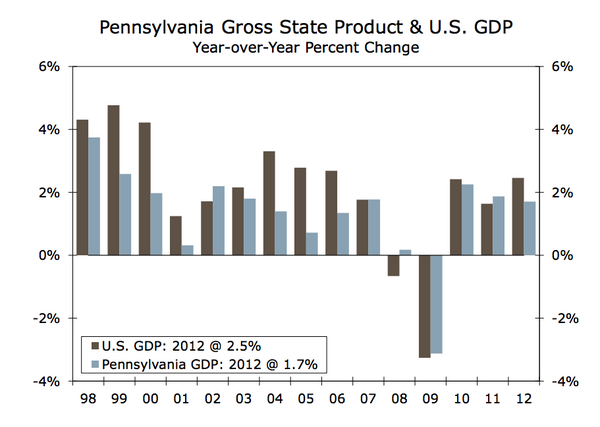

Gross domestic product grew by 1.7 percent in Pennsylvania, below the

2.5 percent national average this year.

Bright spots include what Wells Fargo calls Pennsylvania’s “outsized” education

and health sector, which has continued to grow, along with the leisure and

hospitality industry. And Wells Fargo economists say natural gas exploration

has the potential to reinvigorate the state economy and eventually help attract

manufacturers back to the state. Housing was more stable than other parts of

the country and did not face the same higher percentages of troubled mortgages

and distressed properties.

When discussing public-sector woes, the Wells Fargo report focuses on

Philadelphia and recaps some facts that are well known by most in the local

business community — a $300 million budget shortfall that led to the

elimination of 3,800 public school teachers and staff. That almost led to

schools not starting on time until the city agreed to provide the necessary $50

million.

“Much more is required for the district to return services to what was

offered just a few years ago, before the district closed 24 schools to cut

costs,” Wells Fargo said in its report. “The teachers’ union has been unwilling

to make the concessions, including wage cuts, more work days and higher health

care costs, that city and state officials are requesting. Although the state

managed a small fiscal surplus for the 2012/2013 fiscal year, officials have

not come up with a plan to reign in the rising cost of future pension

liabilities. Furthermore, the state’s classroom funding for the 2013/2014 year

is still $681 million lower than levels seen in 2010/2011.”

Looking forward, Wells Fargo said economic conditions in Pennsylvania

should improve as the drag from public-sector cutbacks wanes.

“Job and income growth should improve and the unemployment rate should

resume its gradual decline, which should boost consumption and breathe new life

in the retail industry.”

Source: Philadelphia

Business Journal

No comments:

Post a Comment